Wrestleknownothing

Members-

Posts

5,980 -

Joined

-

Last visited

-

Days Won

70

Content Type

Forums

Articles

Teams

College Commitments

Rankings

Authors

Jobs

Store

Everything posted by Wrestleknownothing

-

Why are there 33 NCAA qualifiers per weight?

Wrestleknownothing replied to peanut's topic in College Wrestling

No worries. I appreciate the help. Anf I love the fact that in 1966 Sanders finished 3rd at D2, but 1st at D1. -

Why are there 33 NCAA qualifiers per weight?

Wrestleknownothing replied to peanut's topic in College Wrestling

Then bring back the dual affiliation. Whatever it takes, give me more. -

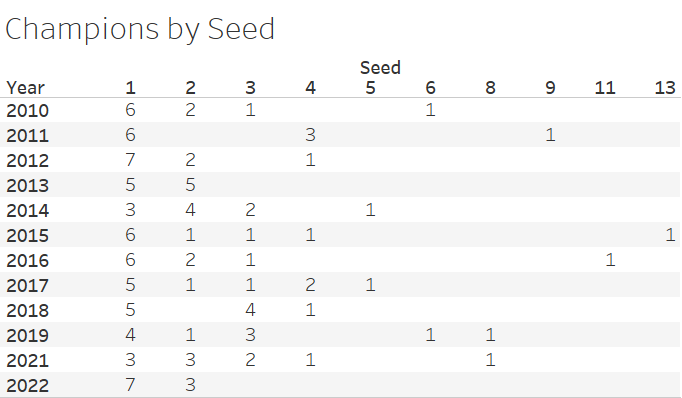

In seven of the past eleven tournaments at least one wrestler ranked outside of the top 4 has won a title. Who will it be this year?

-

Lee and Diakomihalis. Because I want there to be beautiful things in the world.

-

Why are there 33 NCAA qualifiers per weight?

Wrestleknownothing replied to peanut's topic in College Wrestling

Bring back NAIA too, while we are at it. I think this is the complete list of non-D1 D1 champs. Bolded and underlined means they were also outstanding wrestler that year. -

Chances of 10 pins in NCAA Finals by Medicinnabon

Wrestleknownothing replied to MedicineMan's topic in College Wrestling

Gimpeltf, Gimpeltf, He's my man. -

https://www.wrestlestat.com/rankings/statistical Wyatt Hendrickson 14

-

Chances of 10 pins in NCAA Finals by Medicinnabon

Wrestleknownothing replied to MedicineMan's topic in College Wrestling

I am not sure what it is about pinfall that I love so much, but then who can explain love? Maybe because it seems old fashioned and archaic to me, even if it is neither. I just love it. And that it drives @ionel to distraction is just a bonus. By the way, why is fall acceptible? Wrestlers fon't fall. Fall implies no outside agency. A fall is an accident. A fall is something we inflict on ourselves. A fall is preceeded by a trip. And followed by a broken hip. I have talked myself into pinfall is superior to fall. -

Why are there 33 NCAA qualifiers per weight?

Wrestleknownothing replied to peanut's topic in College Wrestling

I like this idea, but instead of taking the place of 31-33, how about having 4 pigtails instead of 1? 33 gets D2 champ, 32 gets D3 champ, 31 gets D2 runner up, and 30 gets 29 in the four pigtails. -

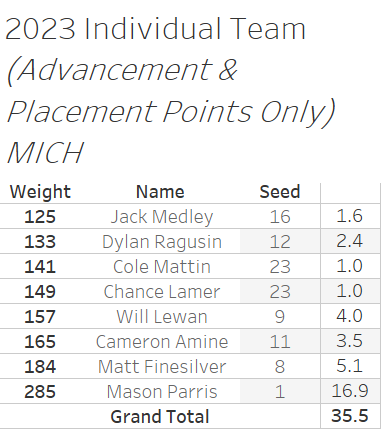

I do things a little differently than that. Rather than guess a finish (usually done by fans and too optimistically) or assume the finish will equal the seed (how all the ranking websites do it), I take a look at the empirical results for a given seed. For example, a #1 seed has finished with an average of 17 advancement and placement points between 2010 and 2022. The problem with the ranking website approach is that it gives too much credit to the top 8 seeds at the expense of giving no credit to the next 25 seeds even though it never happens that way in real life. So for Michigan it looks like this: The expectation is that every one of my estimates will be wrong, but I will be right on average (hopefully).

-

No winkie needed. I got it. The article actually presented worries that there is a larger effect rather than actual evidence of one. Capital markets have been known to over-react to news on occasion. I am not saying that today's price moves are over-reactions, but they are also not evidence of anything. They are just the current consensus view. As for FDIC insurance it is per depositor, per bank. So to get a multiplier on your coverage you would need to spread your deposits among many banks. You can see why that would be practically difficult for business accounts. If you are using the money to make payroll you need the money to come from a single account, for example. And one of the confounding issues at these three banks is that their depositors were primarily businesses with large, unstable balances that were not covered by FDIC insurance. Now the real thing to understand about deposit insurance is that it is all about confidence. It was instituted to give retail depositors confidence in banks at a time when confidence in banks was in short supply. There is a very good reason for this. The maturity mis-match that banks provide (borrow short-term, lend long-term) is very valuable to the economy. It is how deposits get turned into productive uses for things like mortgages and business loans. The government wants to promote that activity so they provide the insurance that makes it possible for you and me not to think about our bank accounts as anything but 100% money good. And when it comes to savings deposits there really is no such thing as 99% sure. You are either sure, or you are not. In this instance the government decided to extend the insurance coverage beyond the $250k limit because there was good reason to. The loans and bonds that these banks have outstanding do not appear to be the issue (depositor flight is the issue). They have good collateral, it is just locked up in long-term loans. In that scenario it makes sense for the government to effectively lend them money to satisfy withdrawals and take the loans and bonds as collateral against those loans. In this way the government effectively replaces the depositors. There are some confounding accounting issues as well, but this is already too long to go down that rabbit hole.

-

It was 3-2 with Lee getting the only TD of the match. Woods' slide by attempt 15 seconds in was probably the closest he came to scoring.

-

At a minimum his offense looks much improved this year. Against Lee he was never close to scoring, if I recall correctly. But this year looks different to my untrained eye. For that reason he is my favorite in spite of losing three in a row at the end of the last tournament.

-

You will not want to hear this, but I have them coming in 12th with 36 plus bonus.

-

I always found that sixth place to be odd. He lost to Nick Lee by 1 when Lee was destroying everyone else. He lost to Sebastian Rivera by the same 3-2 score. I thought he was third best last year, but then he went and lost to Cole Matthews in the fifth place match. Hard to explain.

-

Let me take a crack at this. All banks work pretty much the same way. They take either maturity risk (i.e. borrow short-term and lend long-term), credit risk, or both. This can be done very riskily or not. To mitigate some of that risk some banks also pursue fee based businesses. But an old school, traditional bank activity is to take deposits (borrow short-term) and pay little or no interest on those deposits. They then make longer-term loans to businesses and individuals (mortgages, for example). Long-term rates tend to be higher than short-term rates, so they make money on the spread. But there is a basic problem all banks need to manage. The deposits can leave at any time, but they do not have the right to call the loans. If all depositors want all of their money back at the same time, every single bank in the world will become insolvent. They can make the most prudent, intelligent loans ever that are all money good and it still will not matter. They have to wait to get their money back, but depositors do not. One way to manage this risk is to have diversified sources of depositors. Open branches everywhere, offer toasters and pens, advertise locally and nationally, etc. That way all depositors are less likely to act as a single group. Silvergate and Signature were two large bankers for the crypto industry. Their deposits were tightly tied to the health of crypto as many of their customers were crypto exchanges who needed access to the traditional financial system. When crypto exchanges faced massive withdrawals, they took their deposits en masse. It no longer mattered what their loans looked like. Ditto for Silicon Valley Bank, except substitute private equity funded start ups for crypto. With start up money drying up they turned from net depositors to net withdrawers. SVB also failed to manage their maturity risk appropriately so that when the mark-to-market value of their loans (i.e. long dated treasuries and agency mortgage bonds) went down their capital ratio shrunk. Private equity investors noticed and told all their clients to pull their deposits. When the heard moves, there is not much that can be done (especially if you have mis-managed this risk). Ultimately, it was the combination of losing non-diversified deposits and higher interest rates (which decreased the current value of assets, but not necessarily the future value) that got all three. Unless other banks have made similar mistakes, then they have not much to worry about, except that all banks survive on depositor confidence - just ask George Bailey.

-

care to make a wager....never mind

-

How wild is it that the returning finalists at 197 are the #14 and #9 seeds this year?

-

Including himself if you are implying he will win.

-

The "no Big 10" champ picks

Wrestleknownothing replied to Jimmy Cinnabon's topic in College Wrestling

How is this for strange, but true? Jones and Lewnes both lost to a Hofstra wrestler in the first round. -

The "no Big 10" champ picks

Wrestleknownothing replied to Jimmy Cinnabon's topic in College Wrestling

oops. forgot to mention the year. 2009. -

The "no Big 10" champ picks

Wrestleknownothing replied to Jimmy Cinnabon's topic in College Wrestling

You got me curious. The last #1 seed to lose in the first round was not that long ago. Mack Lewnes 165 for Cornell went 0-2. And neither guy who beat him made All-American. Also interesting, Lewnes went 4th, 0-2, 2nd, 4th. So I doubt he was a fluke #1. -

Chances of 10 pins in NCAA Finals by Medicinnabon

Wrestleknownothing replied to MedicineMan's topic in College Wrestling

Depends. What is Twitter? -

Yet another unflattering imahe of our kind

Wrestleknownothing replied to jackwebster's topic in College Wrestling

The 15 minute edit window is not a good imahe either. -

On HR they are saying it is Connor McGonagle from Lehigh who is out. He was the 11 seed. Not sure if they re-seed or not.