-

Playwire Ad Area

-

Playwire Ad Area

-

Playwire Ad Area

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

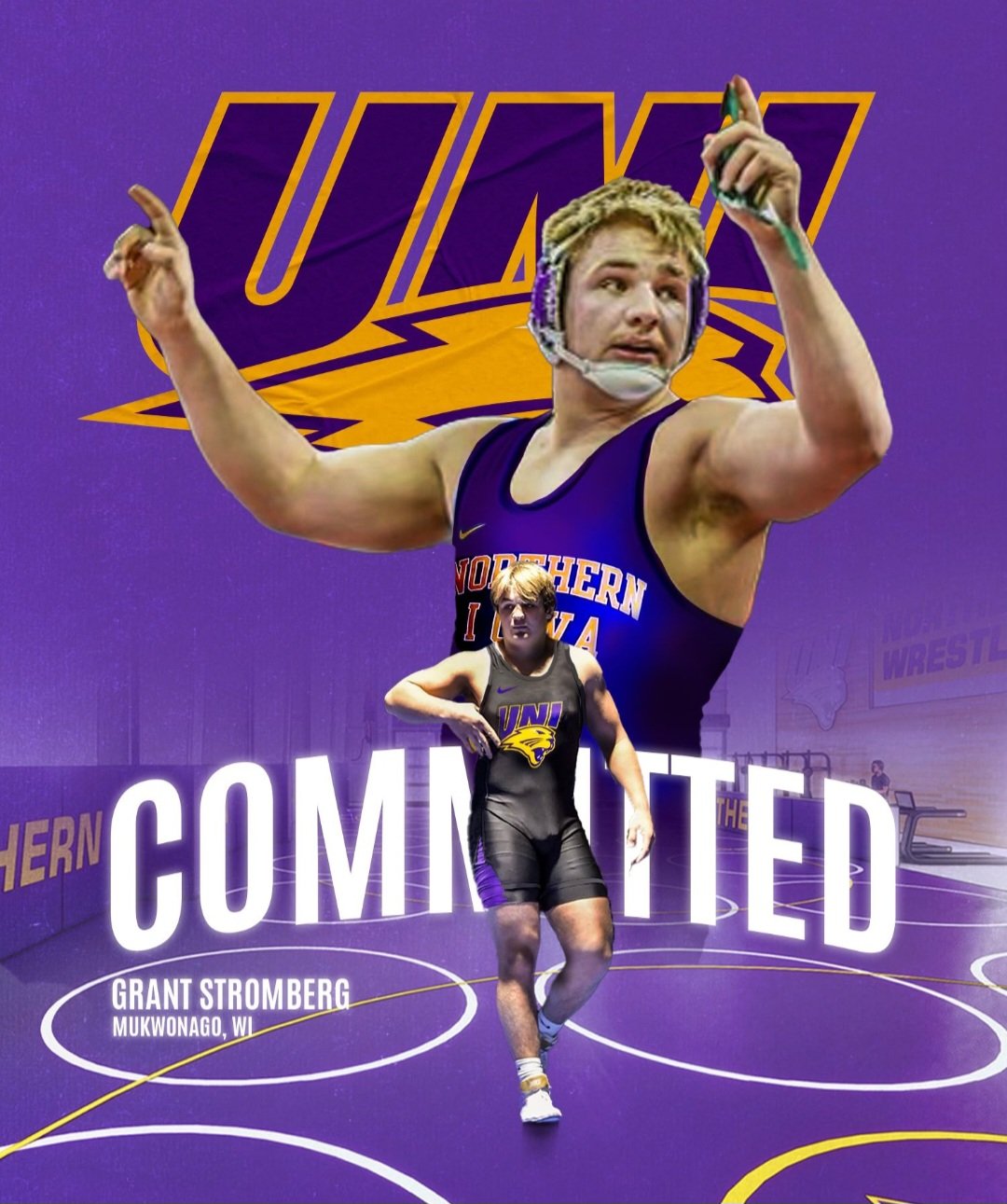

Grant Stromberg

Mukwonago, Wisconsin

Class of 2024

Committed to Northern Iowa

Projected Weight: 285

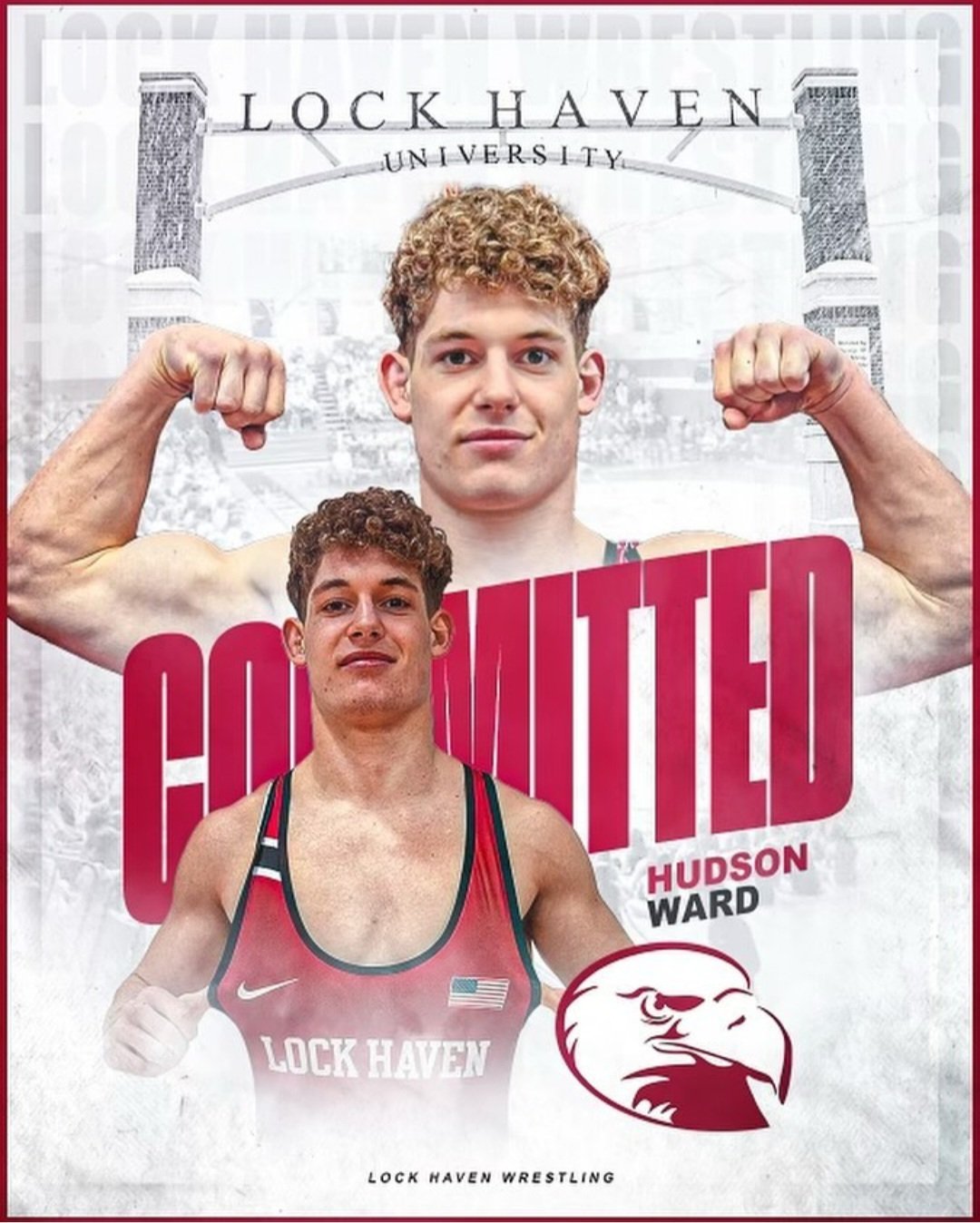

Hudson Ward

Canton, Pennsylvania

Class of 2024

Committed to Lock Haven

Projected Weight: 165

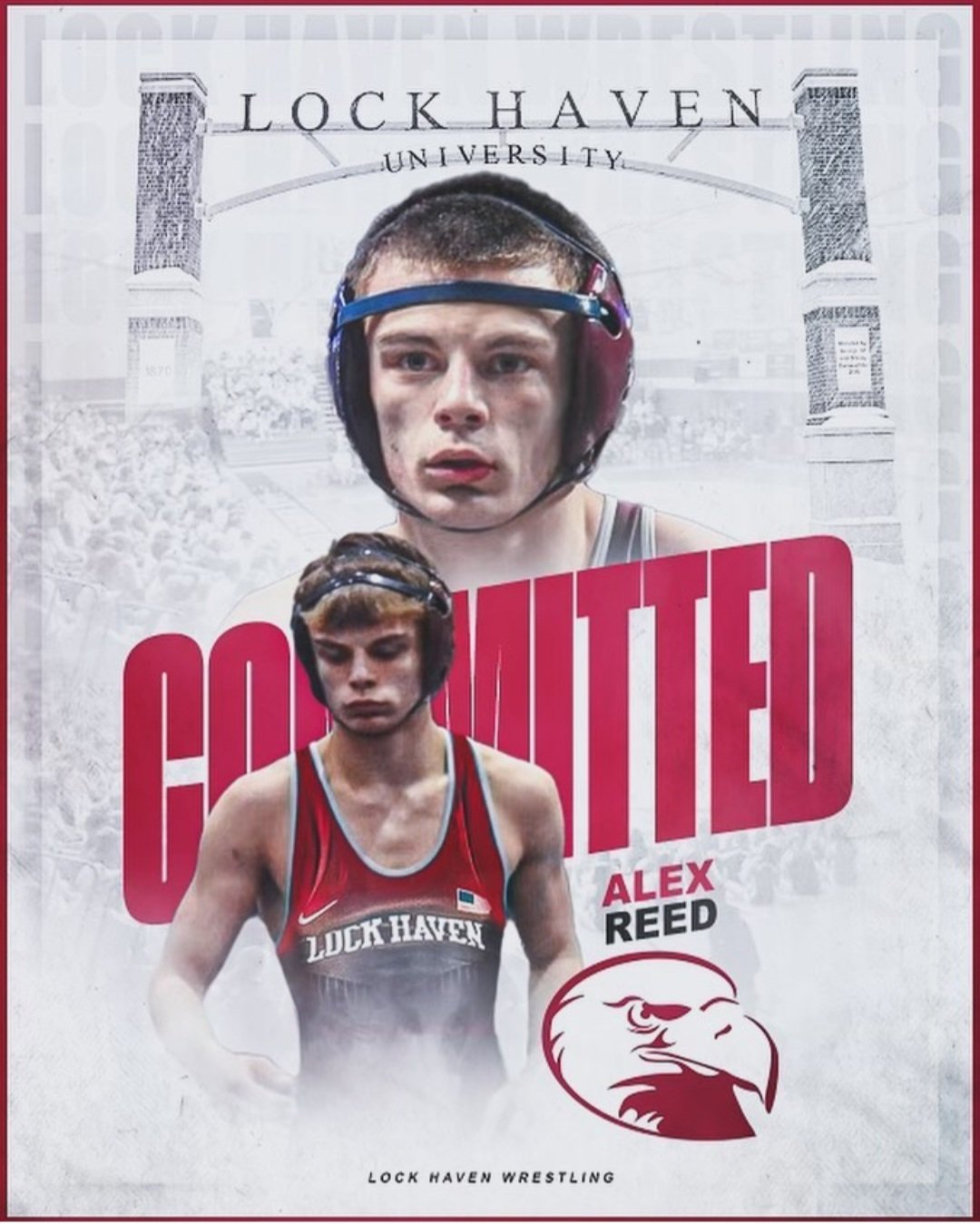

Alex Reed

Shikellamy, Pennsylvania

Class of 2024

Committed to Lock Haven

Projected Weight: 125

Darren Florance

Harpursville, New York

Class of 2024

Committed to Lock Haven

Projected Weight: 125

-

Playwire Ad Area

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now